Frequently Asked Questions

Arkansas Closings Made Simple

FAQs

What does a title company do?

A title company protects your ownership of a property. We:

Research the property’s history

Make sure the seller really owns it

Check for problems like liens, unpaid taxes, or heir issues

Provide title insurance

Hold and distribute money safely

Prepare and record closing documents

Make sure buyers, sellers, lenders, and Realtors are all on the same page

In simple terms:

We make sure the home or land you’re buying legally belongs to you — with no hidden surprises.

What is a title search?

A title search is when we dig through public records to look for:

Past deeds

Mortgages

Liens and judgments

Tax issues

Easements

Boundary descriptions

Transfers through estates or heirs

This helps us confirm that the title is clean and ready to transfer to you.

If a problem shows up, we fix it before closing.

What is escrow?

Escrow is when a neutral third party (like us) holds the money and documents until everyone has met their obligations.

In other words:

We make sure no one pays or receives anything until the deal is 100% correct.

What is “title insurance” and why do I need it?

Title insurance protects you if something in the property’s history pops up later — like:

A forgotten lien

An undisclosed heir

A recording mistake

A wrong legal description

A boundary dispute

Fraud or forged signatures from past owners

You only pay for title insurance once, at closing, and it protects you for as long as you own the property.

Think of it like a safety net for your biggest investment.

What happens at a real estate closing?

Closing is the final step where you:

Sign documents

Pay any remaining funds

Receive your keys

Become the legal owner

For sellers, closing is when:

You sign over ownership

Outstanding loans are paid

You receive the proceeds from the sale

We prepare everything, explain each document, and file it with the county so the transfer is official under Arkansas law.

How long does it take to close in Arkansas?

Most closings take 30–45 minutes.

The process from contract to closing usually takes:

2–4 weeks for a cash deal

3–6 weeks for a financed deal

We work closely with lenders and Realtors to keep things moving on schedule.

Your step-by-step guide to understanding real estate closings, title insurance, escrow, and property title searches in Arkansas.

Buying or selling property can feel overwhelming, especially if it’s your first time. Cole Title Company makes the process simple by answering the most common questions Arkansas homebuyers, sellers, landowners, and Realtors ask during a closing.

Do I need to attend closing in person?

Usually yes — but not always.

In Arkansas, we can often arrange:

Mail-out closings

Remote signings

Mobile notary appointments

Out-of-state or out-of-country closings

Some lenders require in-person signing, so we coordinate with them to find the best option..

What is a “clear title”?

A clear title means:

No liens

No ownership disputes

No claims from past owners

No boundary conflicts

No legal issues

Nothing stopping you from buying or selling

Our job is to confirm that the title is clear before you close.

What is heir property?

Heir property happens when land or a home is passed down without a will. Over the years, many different family members may legally own a percentage — even if they don’t live there.

This is common in rural Arkansas.

Before selling heir property, every owner must be identified and accounted for.

We specialize in tracking down heirs and cleaning up title issues so the property can be legally sold.

What documents will I sign at closing?

Buyers typically sign:

Loan documents (if applicable)

Settlement statement

Title insurance documents

Deed (receiving ownership)

Affidavits required by the lender

Sellers typically sign:

The deed transferring ownership

Closing affidavits

Settlement documents

We explain everything in plain English so you always know what you’re signing.

Who chooses the title company?

In Arkansas, the buyer typically chooses, but this can be negotiated in the contract.

We work with any lender and any Realtor — statewide and beyond.

How does Cole Title Company protect my investment?

We protect your property by:

Checking ownership records

Finding and fixing issues before you close

Providing title insurance

Safely handling your escrow funds

Recording your deed with the county

Ensuring everything is done legally and correctly

Your home, land, or commercial property is one of your biggest investments — and we treat it like one.

Need help? We’re here for you.

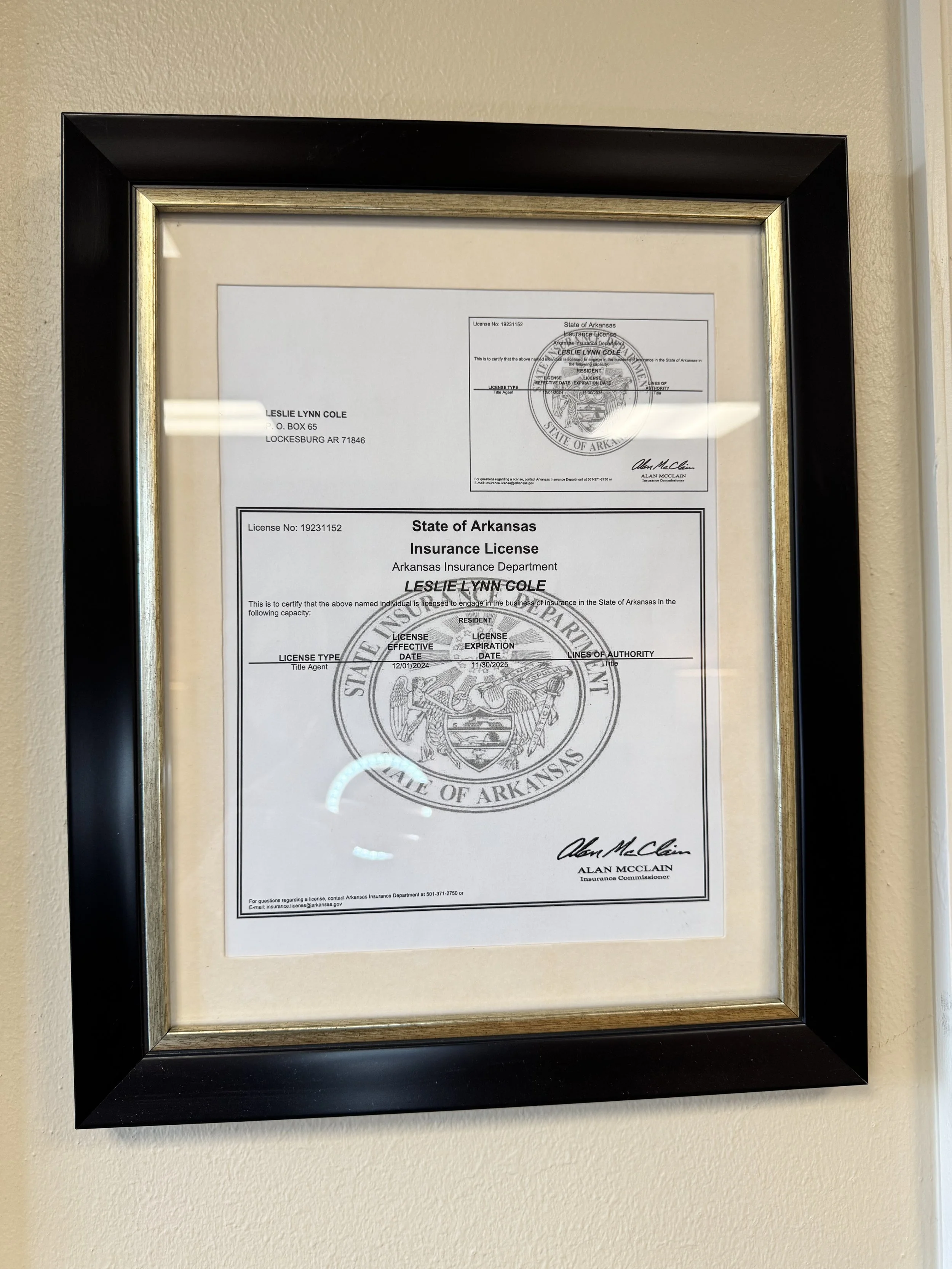

Cole Title Company is proud to be Southwest Arkansas’ trusted source for:

Title Insurance, Real Estate Closings, Escrow Services, Property Title Searches, Land & Rural Property Transactions, Deed Preparation Assistance

If you’re buying, selling, refinancing, or transferring property anywhere in Arkansas, we’re here to guide you.

Arkansas Real Estate Closing Terms Explained (Simple Definitions)

-

The legal document showing who owns the property.

-

A precise description of the land — not just the address.

-

A claim someone else has on a property (like unpaid taxes or a past loan).

-

Someone else’s right to use part of your property (like utilities).

-

A breakdown of all the money involved in the closing.

-

When the county files your deed and makes you the official owner.

Questions?

Questions?

Interested in working together? Fill out some info and we will be in touch shortly! We can't wait to hear from you!